Updated: August 31, 2025 (Europe/London) — The United States has doubled duties on many Indian goods to as much as 50%, a dramatic escalation that immediately rattled currency and equity markets and threatens to tear a hole in India’s export engine. The move, ordered on August 27, 2025, is framed by Washington as punishment for New Delhi’s continued purchases of discounted Russian oil.

Key numbers at a glance

- Scope: Exporter groups and officials estimate ~55% of India’s merchandise exports to the U.S. are in the firing line. In 2024, India shipped $87.3 billion in goods to America.

- Sectors hit: Garments/apparel, gems & jewellery, footwear, furniture, chemicals and other labor-intensive lines.

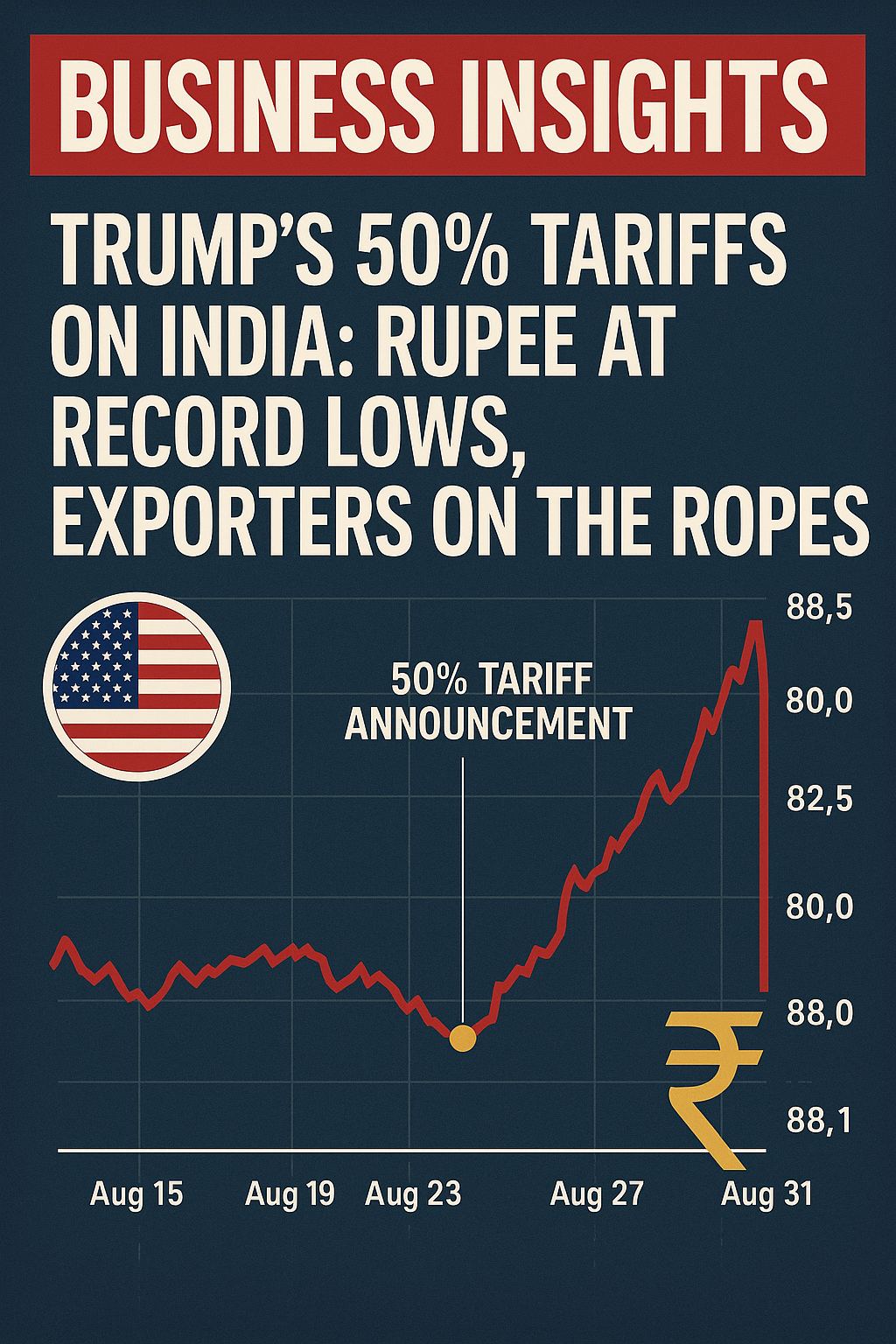

- Rupee reaction: The INR hit an all-time low, touching ₹88.3075 per USD intraday on Aug 29 and settling near ₹88.20—a fourth straight monthly loss.

What changed—and why it matters

The tariff rate—effectively doubling from prior levels to a ceiling of 50%—is among the steepest U.S. actions against a major trading partner in recent years. The White House’s stated rationale: India’s Russian oil purchases, which it argues indirectly finance Moscow’s war effort. For India, which counts the U.S. as its largest single export market, the economic and diplomatic stakes are unusually high.

Officials and trade groups warn the new wall of duties will erase hard-won competitiveness in sensitive categories where margins are thin and buyers can switch quickly to Vietnam, Bangladesh, Mexico or China. Early estimates suggest a 20–30% decline in shipments starting September if the measures persist, with some subsectors at risk of deeper cuts.

Currency and markets: the immediate damage

Financial markets reacted first. The rupee broke the ₹88/$ threshold for the first time, printing a record ₹88.3075 on Aug 29, before closing around ₹88.20. Reuters and high-frequency trackers show the dollar-rupee rate stepping up through the second half of August, with the tariff shock amplifying existing dollar strength and risk aversion.

Equities also wobbled. India’s benchmarks logged another down week into month-end, with foreign investors pulling about $3.3 billion from stocks in August—the heaviest outflow since February—as tariff worries and soft earnings weighed on sentiment. Economists surveyed by Reuters warn the duty shock could shave 60–80 bps off GDP growth if maintained for a year.

Who gets hit—and how badly

The tariff basket is broad and labor-intensive: apparel, gems and jewellery, footwear, furniture and chemicals—all stalwarts of India’s MSME export base. Gujarat’s clusters (including diamond processing) and hubs across Uttar Pradesh and Tamil Nadu are flagged as particularly exposed. With the U.S. accounting for roughly $87.3 billion of India’s 2024 goods exports—and ~55% of lines now affected—analysts fear cascading effects on factory employment, working-capital cycles and capex.

Small exporters report new orders paused or cancelled as buyers reassess landed costs, and councils warn of a scramble to divert shipments to Europe, Africa and parts of Asia. Government interlocutors have discussed credit support and subsidised financing if losses mount, though officials are also urging firms to diversify markets—a notoriously slow pivot in capacity-constrained segments.

Macro outlook: growth, inflation, and the RBI’s tightrope

If tariffs persist, India faces a three-part macro squeeze:

- Growth: Lower U.S. demand and loss of price competitiveness reduce export volumes, pressuring manufacturing and allied services. Baseline estimates point to 0.6–0.8 pp trimmed from growth over 12 months.

- Prices: A weaker rupee can raise imported input costs (energy, components), nudging inflation higher and complicating the Reserve Bank of India’s calculus.

- Flows: Sustained FPI outflows keep financial conditions tighter, raising equity risk premia and potentially lifting borrowing costs for corporates.

The RBI appears to be lean-intervening to smooth volatility rather than defend a line in the sand. Market pricing and reporting around the Aug 29 spike indicate intraday support as the pair neared fresh records.

Policy choices from here

New Delhi has lodged protests and is seeking a pathway to rollback or relief, even as it signals that India “will not bow down” over strategic energy purchases. In parallel, ministries are working on exporter relief (credit, insurance, compliance easing) while trying to re-route trade to non-U.S. destinations. None of these are quick fixes; in apparel and gems, supply chains and buyer relationships with U.S. retailers took years to build.

For Washington, the calculus carries domestic risks too: consumer price impacts in categories like garments and furniture, and the strategic cost of alienating a key Indo-Pacific partner. Analysts note that sliding U.S.–India trade ties risk wider geopolitical spillovers even as both governments still profess commitment to the Quad.

Bottom line

The tariff shock is already visible in INR price action and portfolio flows; the real-economy hit will arrive over the next few quarters as orders roll off. Unless the two sides carve out exemptions or a staged rollback, expect: softer export prints, a rupee anchored near historic lows, and renewed urgency in India’s push to diversify buyers and move up the value chain.

Sources (selected)

- Reuters: Tariffs take effect; INR hits record low; equity outflows & growth hit. Reuters+3Reuters+3Reuters+3

- The Guardian: Announcement and rationale. The Guardian

- Al Jazeera: Sector impacts, policy response context. Al Jazeera

- USTR: 2024 U.S.–India goods trade totals (imports from India $87.3 bn). United States Trade Representative